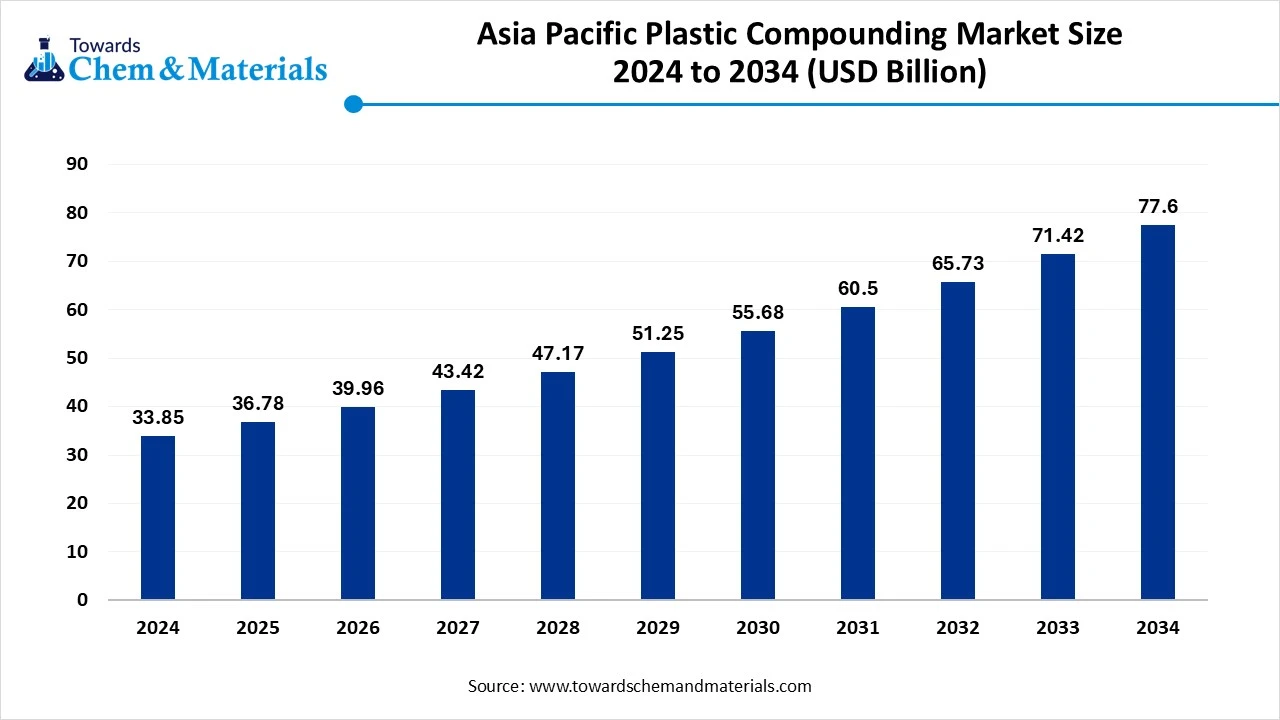

Asia Pacific Plastic Compounding Market Size to Worth USD 77.60 Bn by 2034

According to Towards Chemical and Materials, the Asia Pacific plastic compounding market size was reached at USD 33.85 billion in 2024 and is expected to be worth around USD 77.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.65% over the forecast period 2025 to 2034.

Ottawa, Sept. 08, 2025 (GLOBE NEWSWIRE) -- The Asia Pacific plastic compounding market size is estimated at USD 36.78 billion in 2025 and is expected to reach around USD 77.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.65% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here @ https://www.towardschemandmaterials.com/download-sample/5797

Asia Pacific Plastic Compounding Market Overview

The Asia Pacific plastic compounding market refers to the regional industry involved in the manufacturing and processing of plastic compounds, which are polymer materials that have been modified with additives such as fillers, reinforcements, colorants, flame retardants, and impact modifiers to enhance their mechanical, thermal, electrical, or aesthetic properties.

Plastic compounding involves melting and blending base polymers—such as polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polystyrene (PS), and engineering plastics, with these additives to meet the specific performance requirements of various end-use industries.

Asia Pacific Plastic Compounding Market Report Highlights

- China held approximately a 50% share in the Asia Pacific plastic compounding market in 2024 due to the growing automotive industry.

- By polymer, the polypropylene (PP) segment held approximately a 28% share in the market in 2024 due to the increasing production of exterior & interior automotive parts.

- By functional formulation, the filled & reinforced segment held approximately a 38% share in the market in 2024 due to the increasing production of electric vehicles.

- By end use, the automotive & transportation segment held approximately a 30% share in the market in 2024 due to the strong focus on improving fuel efficiency of vehicles.

- By processing method, the injection molding segment held approximately a 45% share in the market in 2024 due to the growing production of intricate plastic parts.

- By filler type, the talc & CaCO3 segment held approximately a 55% share in the market in 2024 due to the high heat resistance.

- By distribution, the direct to OEMs/tier-1s segment held approximately a 60% share in the Asia Pacific plastic compounding market in 2024 due to the strong focus on direct relationships.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5797

Asia Pacific Plastic Compounding Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 36.78 Billion |

| Revenue forecast in 2033 | USD 77.60 Billion |

| Growth rate | CAGR of 8.65% from 2024 to 2034 |

| Actual data | 2020 - 2024 |

| Forecast period | 2024 - 2034 |

| Quantitative units | Volume in kilotons; revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Polymer/Base Resin, By Functional Formulation / Additive System, By End-Use Industry, By Processing Method (Downstream Use), By Filler/Reinforcement Type, By Distribution Channel, By country |

| Regional scope | Asia Pacific |

| Country scope | Japan, China, India, South Korea |

| Key companies profiled | BASF SE; SABIC; LyondellBasell Industries N.V.; Kraton Polymers Inc.; RTP Company; The 3M Company; Teijin Plastics; Polyplastics Asia Pacific Sdn Bhd; Melchers Malaysia; Helistrom Sdn Bhd; Sheng Foong Plastic Industries Sdn Bhd; The Inabata Group; CIPC Resin; Sin Yong Guan & Co.; Eveready Manufacturing Pte Ltd.; Compounding and Coloring Sdn Bhd |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What are Major Trends in Asia Pacific Plastic Compounding Market?

- Rising Demand for Lightweight and High-Performance Materials: The automotive and electronics sectors are driving demand for lightweight, durable, and heat-resistant compounded plastics to improve fuel efficiency and device performance.

- Growth in Sustainable and Bio-based Compounds: Increasing environmental regulations and consumer preference for eco-friendly products are pushing manufacturers to develop biodegradable, recyclable, and bio-based plastic compounds.

- Expansion of the Electrical & Electronics Industry: The rapid growth of electronics manufacturing in countries like China, India, and South Korea is fueling demand for specialized plastic compounds with enhanced electrical insulation, flame retardancy, and thermal stability.

- Advancements in Polymer Technology and Additives : Innovations in polymer blends, nanocomposites, and smart additives are enabling customized plastic compounds with improved strength, flexibility, and functionality for diverse applications.

-

Increasing Adoption of Automation and Smart Manufacturing : Integration of Industry 4.0 technologies such as IoT, AI, and robotics in compounding processes is improving production efficiency, quality control, and traceability.

What are Major Government Initiatives in Asian Plastic Compounding Industry?

National Policies and Regulations

- China has imposed stringent limits on the import of contaminated plastic waste, significantly impacting global recycling industries and encouraging more sustainable domestic plastic management.

- South Korea has mandated that 30% of government procurement items must incorporate bio-based plastics by 2025, encouraging manufacturers to invest in green material compounding.

Regional Collaborative Projects

- The Asia-Pacific Plastic Waste Project supports customs administrations in the region to better manage plastic waste and enforce regulations that mitigate environmental threats.

- Projects led by regional bodies aim to strengthen tools and protocols for monitoring and managing plastic pollution at national and local levels, especially in critical areas like the Mekong River Basin and Pacific Islands.

Technological Innovation and Research Support

- Partnerships have been fostered to apply advanced technologies such as radiation treatment for recycling plastic waste into value-added materials like wood-plastic composites.

- Governments are encouraging research collaborations between public institutions and private companies to innovate sustainable plastic compounding and recycling methods.

Asia Pacific Plastic Compounding Key Market Drivers

The Asia Pacific plastic compounding market is fueled by rapid industrialization and urbanization, especially in emerging economies like China, India, and Southeast Asia. This growth is driving demand across key sectors such as automotive, electronics, construction, and packaging, where there is a need for lightweight, durable, and high-performance plastic materials. Additionally, increasing consumer preference for advanced plastic compounds that improve product efficiency and reduce costs is further boosting market growth.

Major Market Restraint

Despite its growth, the market faces challenges from stringent environmental regulations aimed at minimizing plastic waste and pollution. These regulations often increase manufacturing complexity and costs. Moreover, the environmental concerns surrounding non-biodegradable plastics and the difficulty in recycling compounded plastics restrict market expansion. Such factors are compelling manufacturers to innovate while managing compliance costs.

Promising Market Opportunity

Significant opportunities exist in the development and adoption of bio-based and biodegradable plastic compounds as sustainability gains prominence. Government initiatives promoting eco-friendly materials are encouraging manufacturers to invest in green technologies. Furthermore, advancements in polymer science and the integration of smart manufacturing processes provide opportunities to create customized compounds tailored to specific industry requirements, paving the way for innovative solutions and long-term market growth.

Asia Pacific Plastic Compounding Market Country-level Analysis:

India Plastic Compounding Market Trends

India’s plastic compounding market is experiencing robust growth driven by rapid industrialization, expanding automotive and electronics sectors, and increasing infrastructure development. The demand for lightweight and high-performance plastic compounds is rising as manufacturers focus on improving product durability and cost-efficiency. Additionally, government initiatives promoting “Make in India” and sustainable manufacturing practices are encouraging investments in advanced compounding technologies. Growing awareness about environmental sustainability is also pushing the market towards bio-based and recyclable plastic compounds, supporting the gradual shift to greener alternatives.

China Plastic Compounding Market Trends

China remains the largest plastic compounding market in Asia Pacific, powered by its vast manufacturing base and extensive industrial activities. The country is witnessing strong demand from automotive, electrical & electronics, packaging, and construction industries. However, stringent environmental regulations, such as strict controls on plastic waste imports and production emissions, are driving the industry to innovate and adopt eco-friendly compounding materials.

The government’s focus on circular economy initiatives and investment in recycling infrastructure are accelerating the development of biodegradable and sustainable plastic compounds. Moreover, China is increasingly incorporating Industry 4.0 technologies like automation and AI into compounding processes to improve efficiency and product quality.

Japan Plastic Compounding Market Trends

Japan’s plastic compounding market is characterized by its emphasis on high-quality, technologically advanced, and specialty compounds. The country’s mature automotive and electronics industries demand innovative materials with enhanced mechanical, thermal, and electrical properties. Japan is a leader in integrating smart manufacturing and automation within the compounding process, optimizing production efficiency.

Additionally, Japan is focused on sustainability, with strong government support for the development of bio-based plastics and strict environmental policies encouraging the reduction of plastic waste. The trend towards personalized and application-specific plastic compounds is also growing, particularly in sectors like healthcare and consumer electronics.

Asia Pacific Plastic Compounding Market Segmental Insights

Polymer Insights

Why Did the Polypropylene Segment Lead the Asia Pacific Plastic Compounding Market?

In 2024, the polypropylene (PP) segment held the leading position in the Asia Pacific plastic compounding market. This dominance is attributed to the rising manufacturing of automotive exterior and interior components such as door panels, bumpers, dashboards, and structural parts, which has boosted the use of polypropylene. Additionally, increased construction activities have driven the demand for PP in applications like films, moisture barrier membranes, and siding materials. Polypropylene is favored due to its excellent chemical resistance, high stiffness, and lightweight nature. The expanding need for PP across diverse sectors—including consumer goods, electronics, automotive, and packaging—further fuels market growth.

Meanwhile, the TPE/TPU & engineering segment is anticipated to be the fastest-growing segment during the forecast period. The surge in consumer electronics production, including smartphones, laptops, and computers, is driving demand for TPE/TPU. Growth in the healthcare industry, along with rising manufacturing of wound care products and medical tubing, also contributes to increased TPE/TPU consumption. Additionally, efforts to reduce emissions and improve fuel efficiency are stimulating demand for TPE/TPUs. Continuous technological innovations in TPU and a growing emphasis on sustainability are key factors supporting the overall expansion of this market segment.

Functional Formulation Insights

Why Did the Filled & Reinforced Segment Capture the Largest Share in the Asia Pacific Plastic Compounding Market?

In 2024, the filled & reinforced segment commanded the largest revenue share in the Asia Pacific plastic compounding market. This growth is driven by the increasing use of materials such as glass fibers, calcium carbonate, and talc across various industries. The rising preference for lightweight materials in the automotive sector has further boosted the adoption of filled & reinforced formulations. Additionally, the expanding production of both electric and conventional vehicles has heightened demand for these formulations. The ongoing development of infrastructure and residential construction projects also contributes to the increased utilization of filled & reinforced compounds, propelling overall market growth.

On the other hand, the flame-retardant & recycled/biobased compounds segment is the fastest-growing segment during the forecast period. Heightened fire safety regulations and the need to minimize fire hazards have spurred demand for flame-retardant materials. Rapid industrialization and a rise in fire-related incidents further drive this demand. Moreover, stringent government policies on plastic waste management and a growing consumer preference for environmentally friendly products are boosting the demand for recycled and biobased compounds. Expanding sectors such as electronics, construction, and automotive are fueling the growth of flame-retardant and recycled/biobased formulations, supporting the overall market expansion.

Functional Formulation Insights

Why Did the Filled & Reinforced Segment Capture the Largest Share in the Asia Pacific Plastic Compounding Market?

In 2024, the filled & reinforced segment commanded the largest revenue share in the Asia Pacific plastic compounding market. This growth is driven by the increasing use of materials such as glass fibers, calcium carbonate, and talc across various industries. The rising preference for lightweight materials in the automotive sector has further boosted the adoption of filled & reinforced formulations. Additionally, the expanding production of both electric and conventional vehicles has heightened demand for these formulations. The ongoing development of infrastructure and residential construction projects also contributes to the increased utilization of filled & reinforced compounds, propelling overall market growth.

On the other hand, the flame-retardant & recycled/biobased compounds segment is the fastest-growing segment during the forecast period. Heightened fire safety regulations and the need to minimize fire hazards have spurred demand for flame-retardant materials. Rapid industrialization and a rise in fire-related incidents further drive this demand. Moreover, stringent government policies on plastic waste management and a growing consumer preference for environmentally friendly products are boosting the demand for recycled and biobased compounds. Expanding sectors such as electronics, construction, and automotive are fueling the growth of flame-retardant and recycled/biobased formulations, supporting the overall market expansion.

End-Use Industry Insights

Which End-Use Industry Led the Asia Pacific Plastic Compounding Market?

In 2024, the automotive & transportation segment was the leading end-use industry in the Asia Pacific plastic compounding market. The increasing production of buses, passenger vehicles, and trucks has driven the demand for plastic compounding materials. The shift toward lightweight materials and the emphasis on enhancing fuel efficiency have further accelerated this demand. Additionally, the rising adoption of electric vehicles and the trend toward customized vehicle designs are boosting the need for plastic compounds. The growing manufacturing of vehicle parts such as door panels, dashboards, and bumpers is also contributing to the expansion of the market.

Meanwhile, the electrical & electronics segment is projected to be the fastest-growing sector during the forecast period. The trend of miniaturizing electronic devices and the advancement of sophisticated electronic components are increasing the demand for plastic compounding. The rise in electric vehicle production is also fueling the need for electronic components used in batteries and charging infrastructure. Furthermore, the production of electronic parts like housings, wire insulation, and dashboards relies heavily on plastic compounding. The widespread use of consumer electronics such as smartphones, wearables, laptops, and computers continues to support robust market growth.

Processing Method (Downstream Use) Insights

Why Did the Injection Molding Segment Command the Largest Share in the Asia Pacific Plastic Compounding Market?

In 2024, the injection molding segment secured the largest revenue share in the Asia Pacific plastic compounding market. This is driven by the rising production of complex plastic components and the capability of injection molding to process a wide variety of plastic materials. The increased manufacturing of both aesthetic and structural vehicle parts has further fueled the demand for injection molding.

Additionally, expanding packaging industries such as pharmaceuticals, food & beverage, and personal care sectors have significantly contributed to the adoption of injection molding. The consistent demand from industries including automotive, healthcare, packaging, and consumer goods is propelling the growth of this segment.

Conversely, the film & sheet extrusion segment is projected to experience the fastest growth throughout the forecast period. Growth in the packaging industry and heightened consumption of packaged foods are boosting demand for film & sheet extrusion. Agricultural uses like silage wrapping, greenhouse coverings, and mulching are also driving growth in this segment. Furthermore, the increasing production of protective layers, insulation materials, and vapor barriers adds to the demand. The rising application of various polymer blends and technological advancements in extrusion processes support the segment's overall expansion.

Filler Type Insights

Why Did the Talc & CaCO3 Segment Lead the Asia Pacific Plastic Compounding Market?

In 2024, the talc & calcium carbonate (CaCO3) segment dominated the Asia Pacific plastic compounding market. The demand for improved rigidity and stiffness in plastic products across various applications has driven the widespread use of talc & CaCO3. A growing emphasis on sustainability and the need for smoother surface finishes have also increased their adoption. These fillers offer excellent heat resistance, reduce oxygen permeability, and provide superior thermal stability. Their strong presence in industries such as construction, consumer goods, automotive, and packaging underpins the overall market growth.

Meanwhile, the glass fibers & nano fillers segment is the fastest-growing category during the forecast period. The push for lightweight materials in aerospace and automotive sectors is accelerating the use of glass fibers and nano fillers. The expanding electric vehicle market and demand for high-performance construction materials also contribute to their rising adoption. Additionally, a focus on extending the shelf life of consumer products is supporting the growth of this segment.

Distribution Channel Insights

How Did the Direct to OEMs/Tier-1s Segment Achieve the Largest Share in the Asia Pacific Plastic Compounding Market?

The direct to OEMs/tier-1s segment held the largest revenue share in 2024. This is attributed to the increasing demand for customized and uniquely designed compounds, which is best served through direct engagement with OEMs and tier-1 suppliers. Consumers’ preference for streamlined communication channels and access to specialized compounded plastics also bolsters this segment’s growth. Moreover, the necessity to optimize supply chains and maintain stringent quality control standards drives procurement directly from OEMs/tier-1s, supporting market expansion.

On the other hand, the distributors/traders segment is expected to experience the fastest growth over the forecast period. Their role in bridging the gap between end users and compounders has become increasingly important. Simplifying the supply chain for manufacturers and providing technical expertise enhances the adoption of distributors and traders. Additionally, growing demand for customized solutions and efficient logistics services further drives growth in this channel.

More Insights in Towards Chemical and Materials:

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- U.S. Plastic Compounding Market : The U.S. plastic compounding market size was reached at USD 11.19 billion in 2024 and is expected to be worth around USD 22.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- U.S. Extruded Polystyrene Market : The U.S. extruded polystyrene market size was reached at USD 1.85 billion in 2024 and is expected to be worth around USD 3.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.75% over the forecast period 2025 to 2034.

- Polymers Market : The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was reached at USD 410.73 billion in 2024 and is expected to be worth around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period 2025 to 2034.

- Transparent Plastics Market ; The global transparent plastics market size was reached at USD 151.53 billion in 2024 and is expected to be worth around USD 245.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.93% over the forecast period 2025 to 2034.

- Plastics Extruded Market : The global plastics extruded market size was reached at USD 175.96 billion in 2024 and is expected to be worth around USD 259.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.95% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- U.S. Transparent Plastics Market : The U.S. transparent plastics market size was reached at USD 20.02 billion in 2024 and is expected to be worth around USD 35.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

- Bio-Based Polymers Market : The global bio-based polymers market size was reached at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period 2025 to 2034.

- Europe Bioplastics Market: The Europe bioplastics market volume was reached at 7.45 million tons in 2024 and is expected to be worth around 40.16 million tons by 2034, growing at a compound annual growth rate (CAGR) of 18.35% over the forecast period 2025 to 2034.

- U.S. Plastics Market : The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- Asia Pacific Plastic Additives Market : The Asia Pacific plastic additives market size was reached at USD 24.85 billion in 2024 and is expected to be worth around USD 40.29 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.95% over the forecast period 2025 to 2034.

- Glass Manufacturing Market : The global glass manufacturing market size was reached at USD 121.77 billion in 2024 and is expected to be worth around USD 211.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.66% over the forecast period 2025 to 2034.

- Plastic Lidding Films Market : The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034.

- U.S. Cosmetic Chemicals Market : The U.S. cosmetic chemicals market size was reached at USD 1.15 billion in 2024 and is expected to be worth around USD 4.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period 2025 to 2034.

- Extruded Polystyrene Market : The global extruded polystyrene market size was reached at USD 7.19 billion in 2024 and is expected to be worth around USD 12.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics Market : The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034.

- Green Cement Market : The global green cement market size was reached at USD 38.19 billion in 2024 and is expected to be worth around USD 69.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15% over the forecast period 2025 to 2034.

- Asia Pacific Fertilizers Market : The Asia Pacific fertilizers market size was valued at USD 168.71 billion in 2024 and is anticipated to reach around USD 313.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.39% over the forecast period from 2025 to 2034.

Asia Pacific Plastic Compounding Market Top Key Companies:

- LyondellBasell Industries N.V.

- Teijin Plastics

- Kraton Polymers Inc.

- RTP Company

- BASF SE

- SABIC

- The 3M Company

- Polyplastics Asia Pacific Sdn Bhd

- Melchers Malaysia

- Helistrom Sdn Bhd

- Sheng Foong Plastic Industries Sdn Bhd

- The Inabata Group

- CIPC Resin

- Sin Yong Guan & Co.

- Eveready Manufacturing Pte Ltd.

- Compounding and Coloring Sdn Bhd

Asia Pacific Plastic Compounding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Asia Pacific Plastic Compounding Market

By Polymer/Base Resin

- Polypropylene (PP)

- Polyethylene (PE: HDPE/LDPE/LLDPE)

- PVC

- ABS

- Polycarbonate (PC)

- Polyamides (PA6, PA66)

- PBT & PET

- TPE/TPU & Elastomeric Compounds

- PS & HIPS

- Engineering/Specialty (POM, PPS, PEEK), Others

By Functional Formulation / Additive System

- Filled & Reinforced (GF, talc, CaCO₃, mica)

- Flame-Retardant (incl. halogen-free)

- Impact-Modified / Toughened

- UV/Heat Stabilized & Weatherable

- Color & Masterbatches

- Conductive/EMI-Shielding & Antistatic

- Recycled/Biobased Content Compounds

By End-Use Industry

- Automotive & Transportation (ICE & EV)

- Electrical & Electronics (Consumer, 5G, Batteries)

- Packaging (Rigid & Flexible)

- Building & Construction

- Appliances/White Goods & Consumer Durables

- Healthcare & Medical Devices

- Others (Industrial, Agriculture)

By Processing Method (Downstream Use)

- Injection Molding

- Extrusion (Profiles, Sheets)

- Film & Sheet Extrusion

- Blow Molding

- Others (Rotomolding, Thermoforming)

By Filler/Reinforcement Type

- Glass Fiber

- Talc

- Calcium Carbonate

- Mica/Others

- Nano-Fillers & Specialty (CNTs, nanoclays)

By Distribution Channel

- Direct to OEMs/Tier-1s

- Through Distributors/Traders

- Contract/Custom Compounding

By Countries

- China

- India

- Japan

- South Korea

- ASEAN (Indonesia, Vietnam, Thailand, Malaysia, Philippines, etc.)

- Australia & New Zealand

- Rest of APAC

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5797

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.